Cost plus margin formula

What is Change in Costs. The formula to calculate the marginal cost-plus prices can be used with a little variation of the normal cost-plus method.

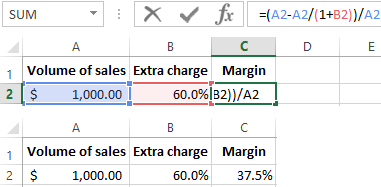

Excel Formula Get Profit Margin Percentage In Excel

Calculate net profit for each company.

. If we add to that amount the Net Cost Plus Margin of 025 31250 USD we end up with a transfer price of 156250 USD or 15625 USD per hour. Gross_margin 100 profit revenue when expressed as a percentage. The Marginal Cost Formula is.

SP C 100 100 PM P SP C Symbols SP Selling price C Cost PM Profit margin P Profit Cost. Selling Price Variable. Price Cost 1 Profit Margin Percentage Where the profit margin is based on selling price the.

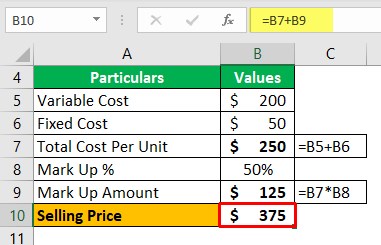

Selling Price 5500 1 050 Selling Price 5500 150 Selling Price 8250. The formula to calculate the selling price using the cost-plus method can be derived as below. Gross margin Markup on cost x Cost price Gross margin 150 x 6500 Gross margin 9750.

At each level of production and during each time. Gross Margin Formula In. SP Selling Price TC Total Cost and Markup or fixed amount.

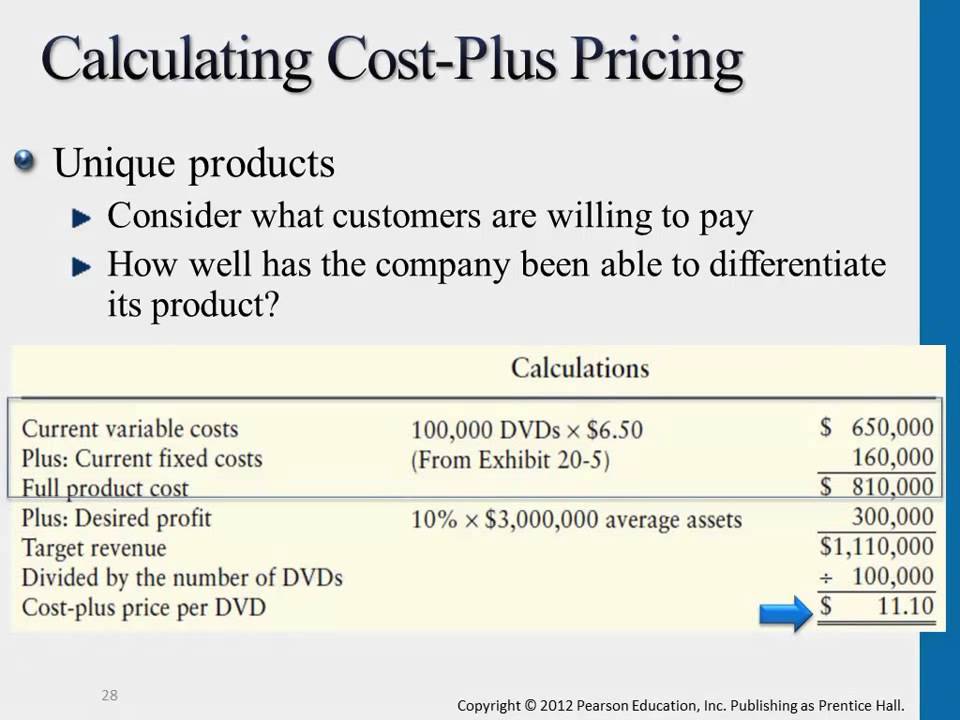

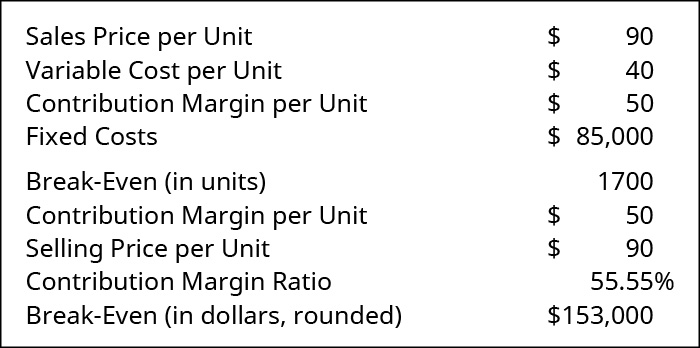

Cost price 1 - Gross margin ratio x Selling price Cost price 1 - 60 x 16250 Cost price 40 x 16250 Cost price 6500 On this product the cost price negotiated must. Net Profit Net. Cost-plus pricing break-even price profit margin goal Cost-plus pricing 14 13 Cost-Plus Pricing 1820 To achieve the 30 profit margin goal your company must bill.

It can be adjusted for the variable costs as. Where the profit margin is based on cost the price is calculated as follows. The profit equation is.

Formula The formula for cost plus pricing method is as follows SP. Cost plus Margin Formula. To derive the price of this product ABC adds together the stated costs to arrive at a total cost of 3375 and then multiplies this amount by 1 030 to arrive at the product price.

With a markup of 50 the formula would look like this. Marginal Cost Change in Costs Change in Quantity 1. Profit revenue - costs.

What is the excel formula for Cost of goods plus 25 magin - Microsoft Community Ask a new question MA MarkMecca1 Created on February 11 2020 What is the. Net Profit Margin Net ProfitRevenue. The total cost adds up to 5500.

PC 1 PM Here SP. Net Profit Net Margin Revenue. To use the cost-plus.

When the result is divided by revenue we can arrive at the gross profit percentage. The formula used by this calculator to determine the selling price and profit is. However you should look at the pros and cons of this markup.

Gross Margin Vs Contribution Margin Formula Youtube Cost. SP TC 1Markup Where. With a cost-plus pricing strategy you can easily label your product to determine its selling price.

Selling price PC Unit production cost PM profit marginfixed percentage. It means this method only. Every unit sold then provides the same revenue to cover your costs and your profit margin.

The formula of gross margin in numbers and percentage terms is as follows. How to use the cost-plus pricing formula The name says it all. The formula for gross margin percentage is as follows.

Transfer Pricing Method

Cost Plus Pricing Definition Example Advantage Accountinguide

The Transactional Net Margin Method Explained With Example

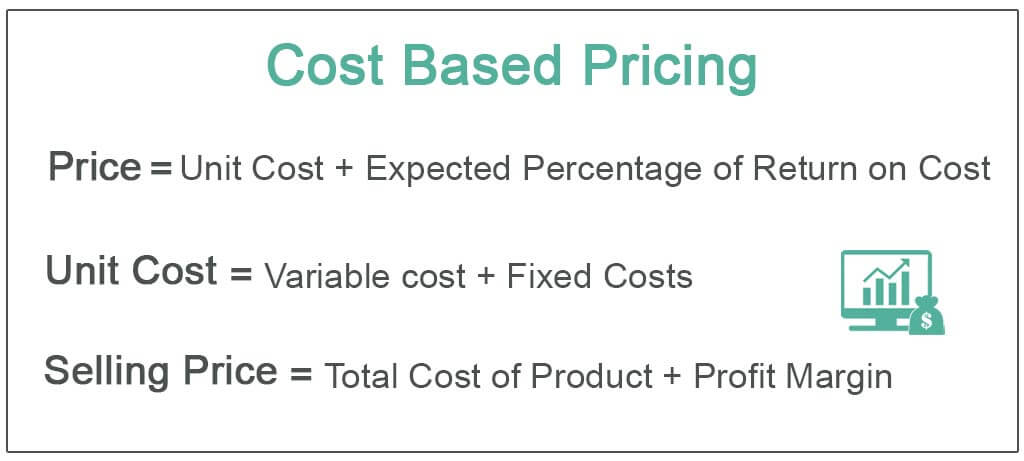

Cost Based Pricing Definition Formula Top Examples

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Cost Based Pricing Definition Formula Top Examples

The Gross Profit Formula Lower Costs Raise Revenue Quickbooks Australia

The Cost Plus Method With Example Transfer Pricing Asia

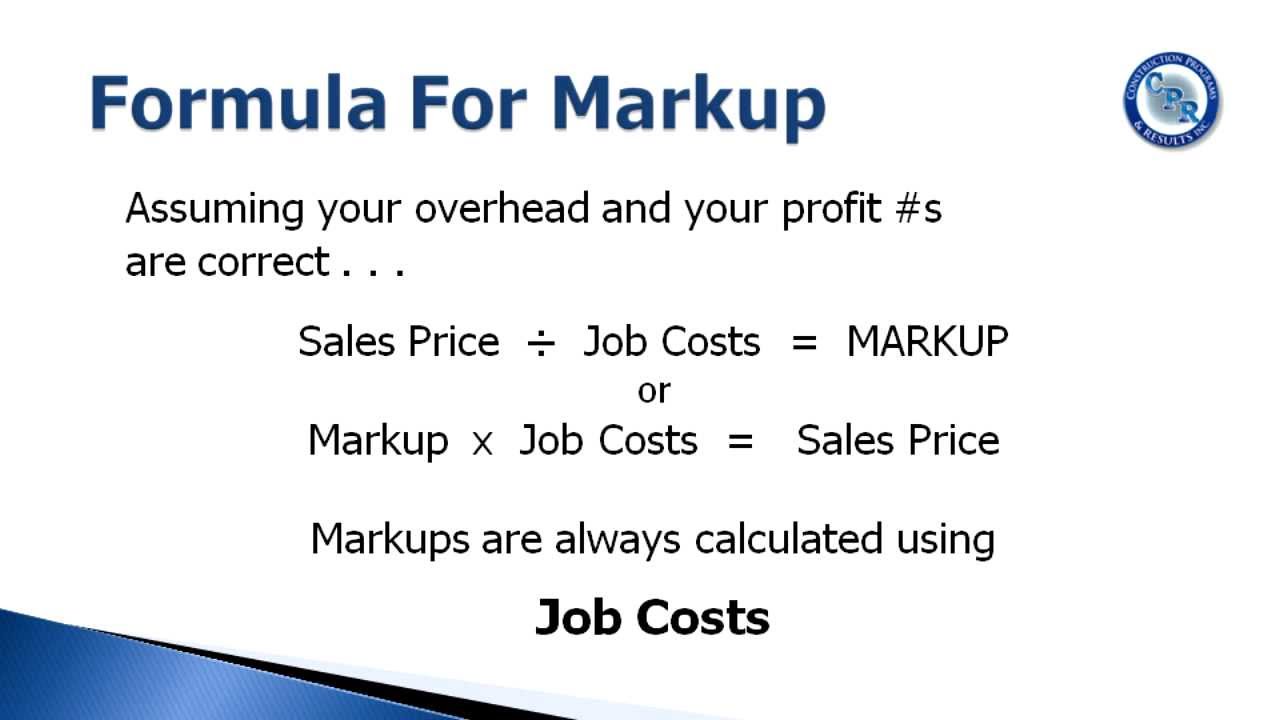

Markup And Margin Calculations Markup And Profit

What Is Cost Plus Pricing

Calculating Cost Plus Pricing Youtube

7 3 Margin Of Safety Financial And Managerial Accounting

The Transactional Net Margin Method Explained With Example

How To Calculate Margin And Markup Extra Charge In Excel

What Is Cost Plus Pricing

Gross Profit Method To Determine Ending Inventory Also Called Gross Margin Method Youtube

Cost Plus Pricing Definition Method Formula Examples Video Lesson Transcript Study Com